When a financial asset is originated or acquired or a financial liability is issued or assumed in a related party transaction, the transaction should be measured in accordance with IAS 24, Related Party Transactions, i.e. Transaction costs expected to be incurred on transfer or disposal of a financial instrument are not included in the initial or subsequent measurement of the financial instruments. costs of the transaction do not include financing fees, debt premiums or discounts.ĭirectly attributable transaction costs relating to financial instruments acquired and recognised at amortised costs are included in the calculation of amortised cost using the effective interest method and consequently are recognised in profit or loss over the life of the instrument. (costs of the transaction include expenditures such as legal fees, reimbursement of the lender’s administrative costs and appraisal costs associated with a loan. Directly attributable costs of the transaction – incremental costs that are directly attributable to the acquisition, issue or disposal of a financial asset or financial liability. IFRS 9: Directly attributable transaction costs are added to or deducted from the carrying value of those financial instruments that are not measured subsequently at fair value.

TRANSACTION COST PROFESSIONAL

Directly attributable expenditure includes, for example, professional fees for legal services, property transfer taxes and other transaction costs.

Market participants must be independent of each other and knowledgeable, and able and willing to enter into transactions. Although costs of the transaction are taken into account when identifying the most advantageous market (in fair value measurement), the fair value is calculated before adjustment for costs of the transaction because these costs are characteristics of the transaction and not the asset or liability.However, if location is a factor, then the market price is adjusted for the costs incurred to transport the asset to that market. Assets at fair value are initially recorded at fair value excluding transaction costs and are subsequently carried at fair value through profit or loss or at fair value through other comprehensive income.

TRANSACTION COST PLUS

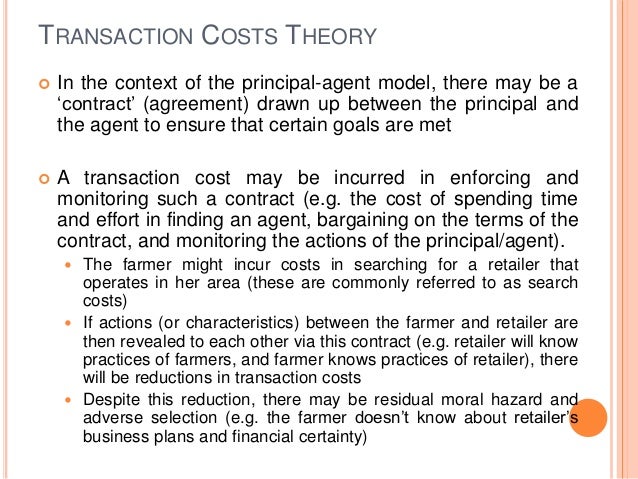

Transaction costs (or costs of the transaction) are of importance in IFRS because they are or are not included in the carrying value at initial recognition.

0 kommentar(er)

0 kommentar(er)